In the waning hours of the 117th Congress, a large government funding bill was passed that includes many provisions that will help Americans save more for retirement.

The Setting Every Community Up for Retirement Enhancement 2.0 Act (SECURE 2.0) was part of the omnibus funding bill. SECURE 2.0 is meant to build on the original SECURE Act, which was signed into law at the end of 2019 and contains major changes in the required minimum distribution (RMD) rules and other retirement provisions. Note: The benefits in the law will kick in over several years.

Here’s a brief rundown of some of the key provisions and when they will become effective:

1. Increase in the age for beginning RMDs. Employer-sponsored qualified retirement plans, traditional IRAs and individual retirement annuities are subject to RMD rules. They require that benefits be distributed or start being distributed by the required beginning date. Under the new law, the required age used to determine distributions increases from age 72 to age 73 starting on January 1, 2023. It will then increase to age 75 starting on January 1, 2033.

2. Higher “catch-up” contributions for participants age 60 through 63. Currently, participants in certain retirement plans can make additional catch-up contributions if they’re age 50 and older. The limit on catch-up contributions to 401(k) plans is $7,500 for 2023. Secure 2.0 will increase the 401(k) plan catch-up contribution limits to the greater of $10,000 or 150% of the regular catch-up amount for individuals age 60 through 63. The increased amounts will be indexed for inflation after 2025. This provision will take effect for taxable years beginning after December 31, 2024. (There will also be increased catch-up amounts for SIMPLE plans.)

3. Better coverage for part-timers. The first SECURE Act requires employers to allow long-term, part-time workers to participate in their 401(k) plans with a dual eligibility requirement (one year of service and at least 1,000 hours worked or three consecutive years of service with 500 hours worked). The new law will reduce the three-year rule to two years, beginning after December 31, 2024. This provision would also extend the long-term part-time coverage rules to 403(b) plans that are subject to ERISA.

4. “Starter” 401(k) plans for employers with no plan. The new law will allow an employer that doesn’t sponsor a retirement plan to offer a starter 401(k) plan (or safe harbor 403(b) plan) that would require all employees to be default enrolled in the plan at a 3% to 15% of compensation deferral rate. The limit on annual deferrals would be the same as the IRA contribution limit with an additional $1,000 in catch-up contributions beginning at age 50. This provision takes effect beginning after December 31, 2023.

5. Tax credit for small employer pension plan start-up costs. The new law increases and makes several changes to the small employer pension plan start-up cost credit to incentivize businesses to establish retirement plans. This takes effect for plan years after December 31, 2022.

6. Retirement savings for military spouses. SECURE 2.0 creates a new tax credit for eligible small employers for each military spouse that begins participating in their eligible defined contribution plan. This provision becomes effective for taxable years beginning after December 31, 2022.

7. Age increased for qualified ABLE programs. Tax-exempt ABLE programs are established by states to assist individuals with disabilities. Currently, in order to be the beneficiary of an ABLE account, an individual’s disability or blindness must have occurred before age 26. SECURE 2.0 increases this age limit to 46, which will make more people eligible to benefit from an ABLE account. This provision is effective for tax years beginning after December 31, 2025.

8. Tax-free rollovers from 529 accounts to Roth IRAs. SECURE 2.0 will permit beneficiaries of 529 college savings accounts to make direct trustee-to-trustee rollovers from a 529 account in their names to their Roth IRAs without tax or penalty. Several rules apply. This provision is effective for distributions after December 31, 2023.

9. First responder retirement payments excluded from income. The new law allows law enforcement officers, firefighters, paramedics and emergency medical technicians to exclude from gross income certain service-related disability pension or annuity payments after they reach retirement age. The exclusion would be effective for amounts received after December 31, 2026.

10. Automatic enrollment in retirement plans. Under the new law, 401(k) and 403(b) plans will be required to automatically enroll employees when they become eligible, beginning with plan years after December 31, 2024. Employees will be permitted to opt-out. The initial automatic enrollment amount would be at least 3% but not more than 10%. Then, the amount would be increased by 1% each year thereafter until it reaches at least 10%, but not more than 15%. All current 401(k) and 403(b) plans are grandfathered. Certain small businesses would be exempt from this requirement.

11. Penalty-free withdrawals for emergencies. The tax code imposes a 10% penalty on the taxable amount of withdrawals from retirement accounts, such as 401(k) plans and IRAs, received before age 59½. There are several exceptions to the 10% penalty on early distributions. SECURE 2.0 adds a new exception for certain distributions used for emergency expenses, which are defined as unforeseeable or immediate financial needs relating to personal or family emergencies. Only one distribution of up to $1,000 is permitted a year, and a taxpayer has the option to repay the distribution within three years. This provision is effective for distributions made after December 31, 2023.

12. “Matching” contributions for employees with student loan debt. The new law will allow an employer to make matching contributions to 401(k) and certain other retirement plans with respect to “qualified student loan payments.” The result of this provision is that employees who can’t afford to save money for retirement because they’re repaying student loan debt can still receive matching contributions from their employers into retirement plans. This will take effect beginning after December 31, 2023.

Sweeping Law

These are only some of the provisions in SECURE 2.0. In the near future, we’ll publish more articles with additional details about the new law. Contact us if you have any questions about your situation.

PKS & Company, P. A. is a full service accounting firm with offices in Salisbury, Ocean City and Lewes that provides traditional accounting services as well as specialized services in the areas of retirement plan audits and administration, medical practice consulting, estate and trust services, fraud and forensic services and payroll services and offers financial planning and investments through PKS Investment Advisors, LLC.

© Copyright 2023. All rights reserved.

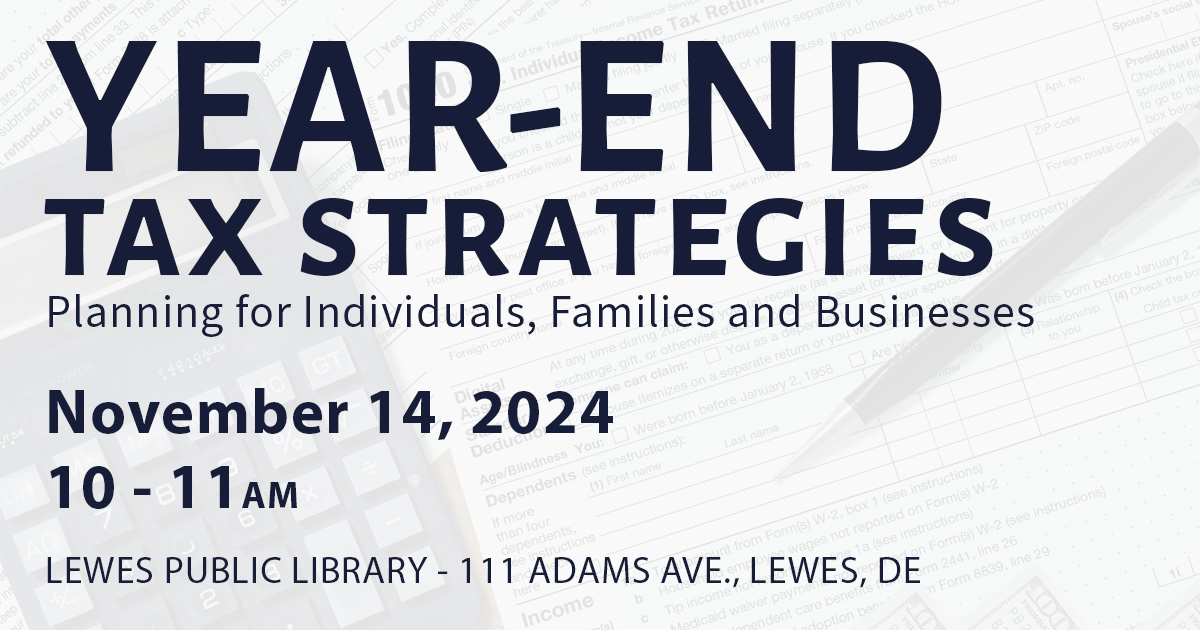

Brought to you by: PKS & Company, P.A.