Overview

Beginning January 1, 2024, a substantial number of businesses will be required to comply with the Corporate Transparency Act (“CTA”), enacted as part of the National Defense Act from the Fiscal Year 2021. It’s intended to close the information gap related to money laundering and other illicit acts.

The CTA is not part of the tax code, but it’s part of the Bank Secrecy Act, which includes laws that require record-keeping and report filings on certain financial transactions. The Financial Crimes Enforcement Network (FinCEN) administers the CTA and requires disclosure of beneficial ownership information (“BOI”) of certain entities.

What Entities Are Subject CTA Reporting Requirements?

Entities required to comply with the CTA (“Reporting Entities”) include corporations, limited liability companies (“LLC’s”), Limited Partnerships (“LP’s”) and other types of entities that are created by a filing with the Secretary of State or equivalent official.

There is an exception for filing for “large operating companies” defined as entities that meet ALL of the following requirements:

- Employ at least twenty (20) full-time employees in the United States.

- Gross revenues (or sales) over $5 million on the prior year’s income tax return.

Has an operating presence at a physical office in the United States.

Reporting Requirements

- Reporting companies created or registered before January 1, 2024, have until January 1, 2025, to file initial reports.

- Reporting companies created or registered after January 1, 2024, will have ninety (90) days after receiving their notice of creation or registration to file initial reports.

What You Need to Know and Do

Management is responsible for your compliance with the CTA and for ensuring that any required reporting of beneficial ownership information is timely filed with FinCEN. Please note that penalties for willfully violating the CTA’s reporting requirements include Civil Penalties of up to $591 per day that the violation has not been corrected, Criminal Fines of up to $10,000, and/or imprisonment for up to two years.

The CTA is not part of the tax code.

The assessment and application of many of the requirements set forth in the regulation, may necessitate legal interpretation, guidance and direction. As such, since we are not attorneys, our firm is not able to provide you with any legal determination as to whether an exemption applies to the nature of your entity or whether legal relations constitute beneficial ownership.

PKS STRONGLY ENCOURAGES YOU TO SEEK LEGAL COUNSEL WITH EXPERIENCE AND EXPERTISE IN THIS AREA TO ASSIST YOU IN COMPLYING WITH THE CTA.

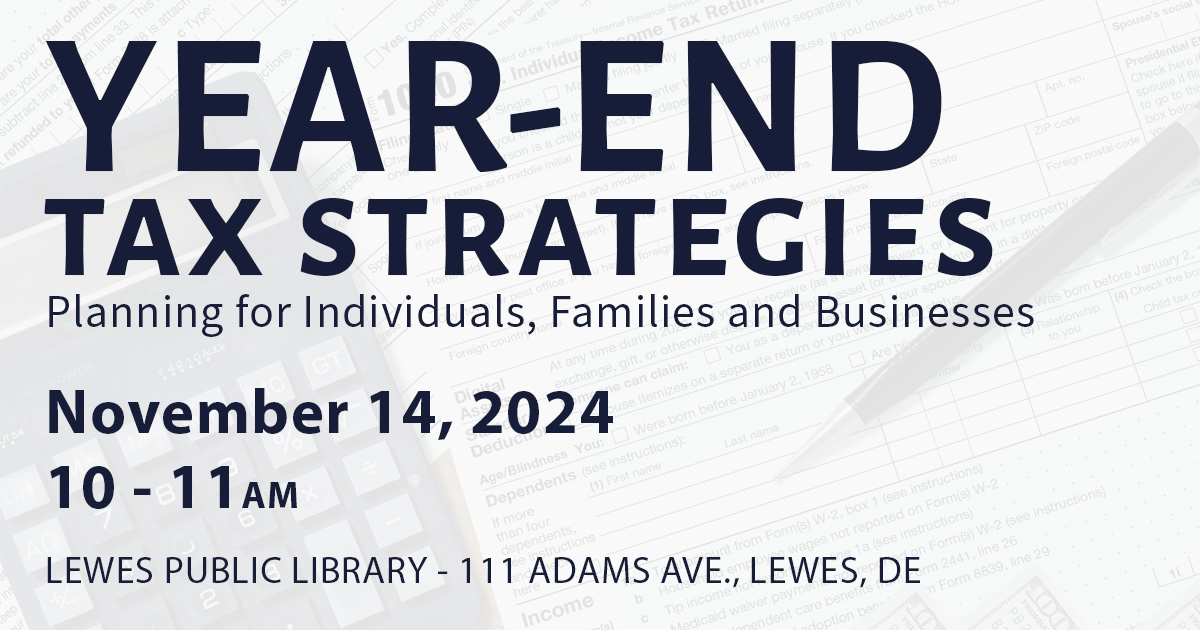

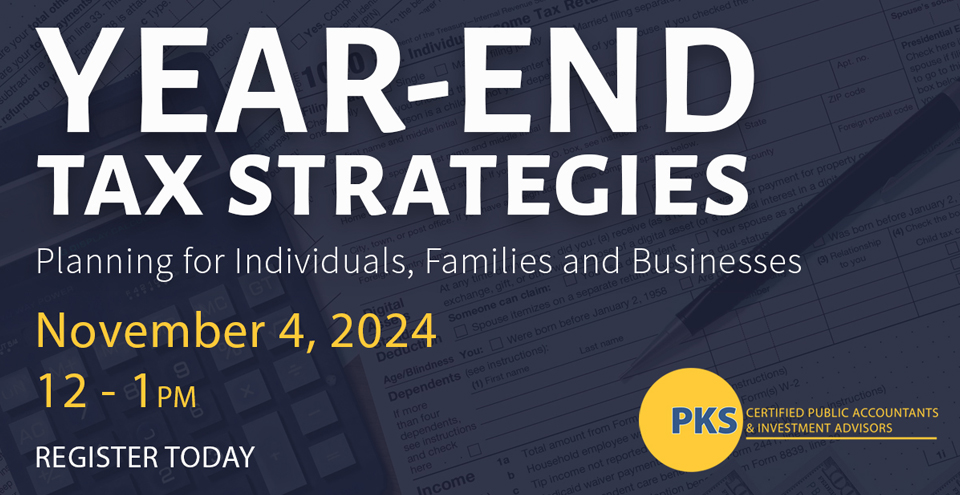

PKS & Company, P. A. is a full service accounting firm with offices in Salisbury, Ocean City and Lewes that provides traditional accounting services as well as specialized services in the areas of retirement plan audits and administration, medical practice consulting, estate and trust services, fraud and forensic services and payroll services and offers financial planning and investments through PKS Investment Advisors, LLC.

© Copyright 2024. All rights reserved.

Brought to you by: PKS & Company, P.A.