Susan P. Keen, CPA, has been elected to the Board of Directors of the Village of Hope. The Village of Hope is a not-for-profit, non-denominational organization that provides a transitional home for at risk women and children in Salisbury, Maryland. Their mission is “To promote self-sufficiency and to improve the quality of life among at-risk women and children.”

Susan is a partner at PKS and has over 30 years of tax and accounting experience. She specializes in advising physician groups and small businesses on their various financial needs, including financial practice consulting and tax and compensation planning. Susan lives in Salisbury with her husband Rick, and has three children, son- Bradley, and twin daughters – Abby and Lindsey. Outside of work Susan enjoys spending time with her family, traveling, reading, watching soccer and going to the beach.

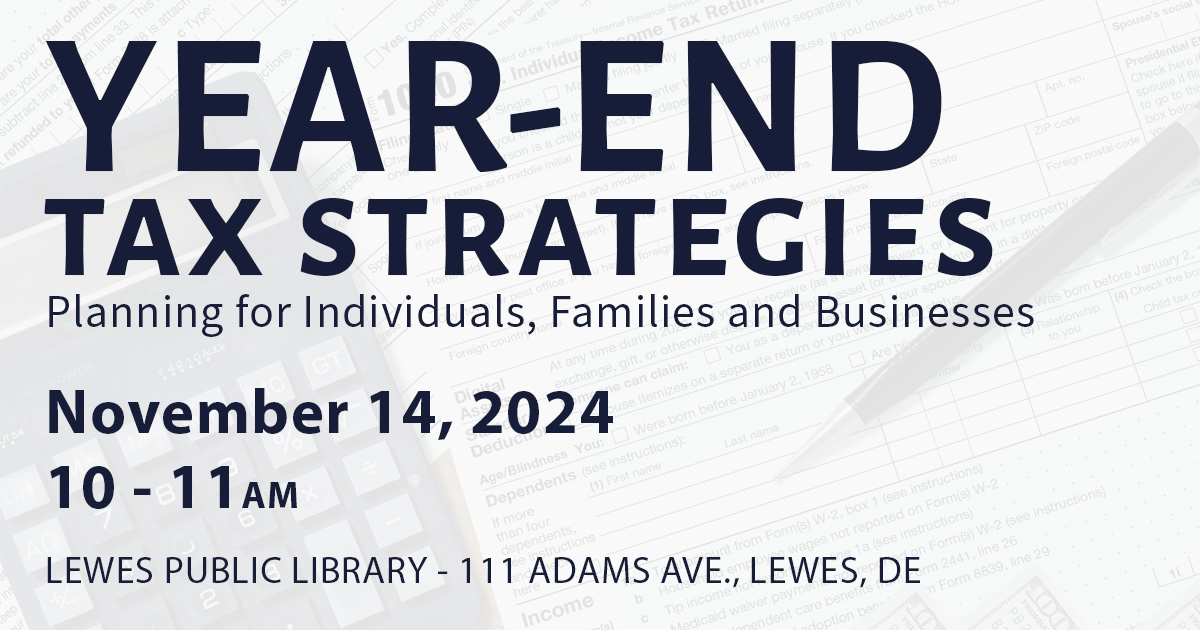

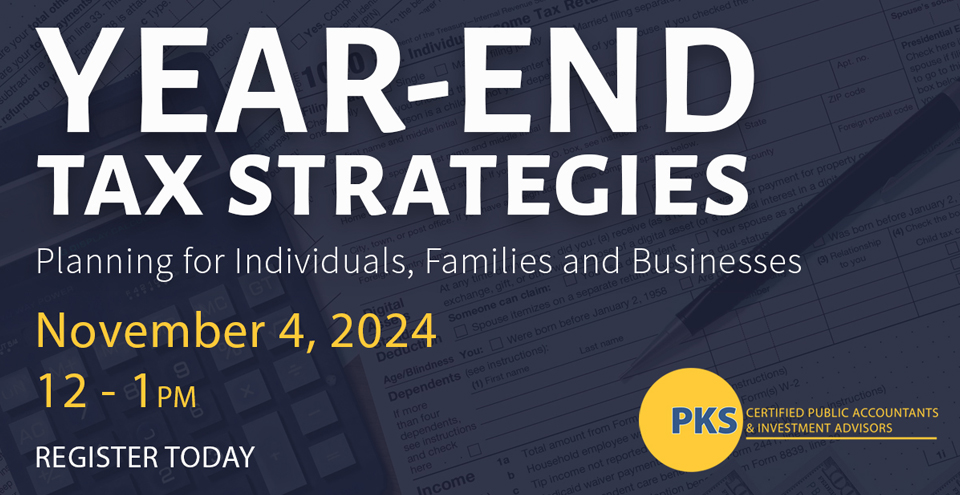

PKS & Company, P. A. is a full service accounting firm with offices in Salisbury, Ocean City and Lewes that provides traditional accounting services as well as specialized services in the areas of retirement plan audits and administration, medical practice consulting, estate and trust services, fraud and forensic services and payroll services and offers financial planning and investments through PKS Investment Advisors, LLC.